Landsea Green Properties 1H2015 Net Profit Up 42% Demonstrating Initial Progress in Implementation of Asset-light Strategy

Time:2015-08-12

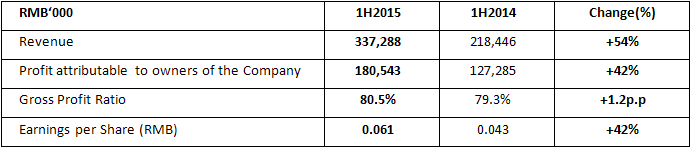

Hong Kong, August 12, 2015 – Landsea Green Properties Co., Ltd., (“Landsea Green Properties” or “the Company”, stock code: 00106), China’s leading property developer and operator with green technology, is pleased to announce its unaudited interim results for the first six months ended 30 June 2015 (the “Period”). During the Period, profit attributable to owners of the Company increased by 42% to RMB181 million. Earnings per share amounted to RMB0.061. Due to a relatively high gross profit ratio in property development and management services income and invested development rental and management income, the Company’s overall gross profit ratio increase to 80.5%.

Results Highlights

Within the Period, the Company recorded the property development and management services income from independent third parties or cooperating parties for the first time. Revenue of the Company reached RMB337 million, representing an increase of 54% as compared to the corresponding period last year, of which income from project development management services was RMB322 million. The income paid to Landsea Group was approximately RMB246 million, and that received from independent third parties or partners reached approximately RMB76 million, accounting for approximately 22.6% of total revenue, demonstrating that Landsea Green Properties had achieved remarkable progress in implementing its asset-light strategy. Contracted sales of the Company during the Period amounted to approximately RMB2,463 million, with contracted floor area of approximately 218,100 square meters. The average sale price was RMB 11,296 per square meter.

During the Period, the Company acquired equity interests in three projects and was responsible for their development and construction. These three projects are joint developments or projects with minority equity interests - two of them are located in Nanjing and the other is in Chengdu - and will involve an additional total floor area of 565,000 square meters and 166,000 square meters of gross floor area attributable to the Company. As at June 30 2015, the Company has a total land reserve of 2.68 million square meters in terms of gross floor area and a total of 1.66 million square meters of gross floor area attributable to the Company.

Entrusted development is another way to obtain new projects. The Company is responsible for development and management of property projects through entrustment with other developers. Although the Company does not have any shares in such projects nor would it receive any gains from equity investment, it can obtain income from development management and technical services and from additional profit-sharing arrangements. In the first half of the year, the Company acquired four entrusted development projects located in Hefei, Nanjing, Wuhan and Wuhu.

The Company is committed to implementing its “asset-light strategy and profit-diversification strategy” and is keen to leverage its existing strengths in technology, branding, project development and management capability to cooperate with sizeable partners in the areas of joint development, projects with minority interests and entrusted development as it strives to become an integrator of both internal and external resources. Apart from diversifying the operational risks of the enterprise and gains on equity investments, such businesses may also generate income from management, technology services, and extra-profit sharing arrangements. The above-mentioned services income will become new points of growth for the Company.

The Company participated in a building rehabilitation project for the first time, marking a new initiative outside the traditional business model for land development. The Hongqiao Luyuan project was located in the core area of the Hongqiao District of Shanghai, which used to be a low-density high-end community in the city. With a total floor area of 15,787 square meters, the project comprises residential buildings located in the core area of a first-tier city. As the prospects for the building rehabilitation business are bright in China’s first-tier cities, the Company will continue to identify suitable building rehabilitation projects in first-tier cities to explore the new business model and to improve its vertical integration capabilities in investment, development, rehabilitation and operation.

In the second half of 2015, the Company will continue to pursue the full implementation of its “asset-light strategy and profit-diversification strategy”. With more endeavors in joint development, projects with minority interests and entrusted development, the Company’s involvement in such activities as a proportion of its total business will increase significantly. In the meantime, the Company will pursue quality growth and focus on both profitability and cash flow. As for its sales strategy, the Company will strike a balance between sales and pricing to accelerate cash inflow to further boost project expansion. In addition to its existing product lines with constant levels of temperature, humidity and oxygen, the Company will launch a 3.0 version product line of green technology residential properties, with ideal control over indoor formaldehyde, volatile organic compounds (VOC) and smog, gaining the remote control function of technological system and fully satisfying high-end customers’ pursuit of a healthy and comfortable living environment, thus enhancing overall project management value. The Company plans to launch the 3.0 version products of Landsea green buildings in Nanjing, Shanghai and Chengdu simultaneously. The Company strives to enhance its market influence in the field of green property, and is determined to bring returns for shareholders amid fierce competition in terms of differentiated products.

Mr. Tian Ming, Executive Director and Chairman of Landsea Green Properties, added, “Despite fierce market competition, Landsea Green Properties has successfully implemented asset-light strategy and has achieved positive initial results riding on its extensive experience and expertise in green property development. By further expanding the asset-light business and proactively seeking new drivers of profit growth, we have great confidence in the Company’s future development. Since the Company is the only listed platform under Landsea Group engaged in the green residential property development business, Landsea Group plans to inject high-quality assets and ancillary service businesses to the listed platform at the right time so as to transfer its brand value, management team, and green property development and ancillary service capabilities to the Company, which will enable the Company to have a listed platform with comprehensive property development and management services.”